LBF Technical Architecture

LBF is a fully decentralised cross-chain bridging framework enabling seamless value transfer across different blockchain networks.

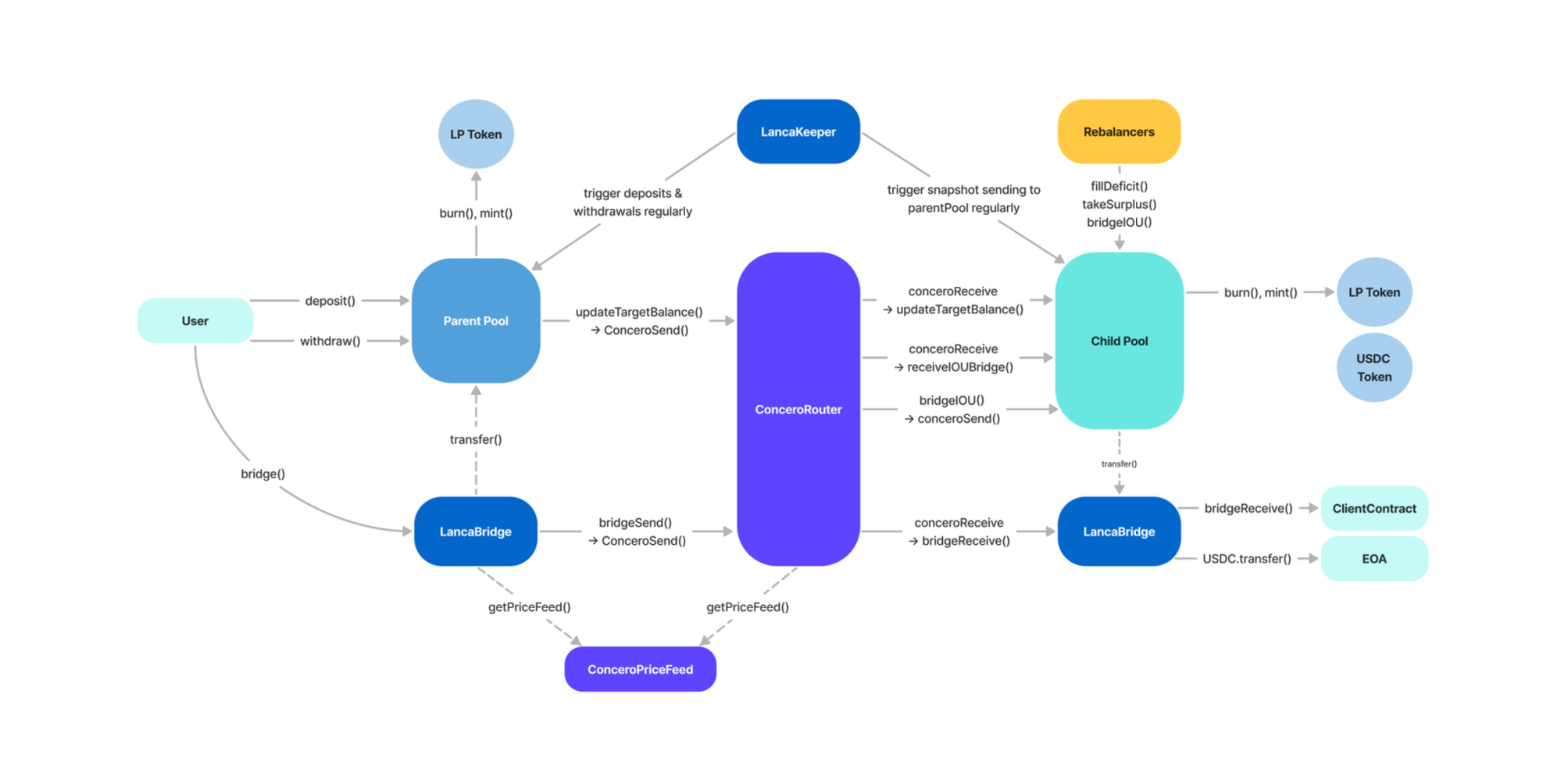

The central Parent Pool is the primary entry/exit point for liquidity providers (LPs), while Child Pools provide instant local settlement and application-facing liquidity on their respective chains. Child pool states are periodically reported back to the Parent pool.

Interchain communication is handled by Concero V2 Messaging, and periodic operational orchestration (liquidity snapshots, batch withdrawals and deposits) is driven by LancaKeeper.

LBF supports a hybrid liquidity management model: an automated planning layer (Parent-assigned targetBalance) is complemented by a market layer — Rebalancers, who earn fees by correcting deficits/surpluses through an IOU mechanism.

Architecture Diagram

Core Components: Parent Pool, Child Pool, LancaBridge (transfer initiator/executor contracts), ConceroRouter (cross-chain message router), ConceroPriceFeed (price oracle), LancaKeeper (automated operator), Rebalancers (market participants performing liquidity balancing).

System Components

Parent Pool (Master Chain)

Primary liquidity hub: accepts LP deposits, mints LP share tokens proportionate to pool ownership, processes batch withdrawals, and computes dynamic targetBalance values for all Child Pools.

The Parent Pool updates liquidity targets based on network activity and Child pool state reports (metrics + balances). Target distribution instructions are dispatched via Concero V2 Messaging.

Child Pool

Local liquidity pool on a destination chain: holds funds for immediate settlement of transfers, periodically reports state back to the Parent Pool, and participates in Rebalancer deposit/withdraw (IOU) operations.

LancaBridge

Contracts on source and destination chains that users call to initiate cross-chain transfers. They assemble the cross-chain payload, and relay it through the ConceroRouter. On the destination chain, the payload is validated and executed—either disbursing funds to the user or invoking the specified downstream contract.

ConceroRouter (Concero V2 Messaging)

Secure delivery of cross-chain messages/instructions ensuring Parent↔Child consistency, IOU burn/mint, and interchain contract calls. Cryptographic and economic security properties come from Concero Messaging.

LancaKeeper

Automated (off-chain + privileged on-chain) operator that:

- Triggers periodic Child pool liquidity snapshots;

- Initiates batch deposits/withdrawals at the Parent Pool;

- Finalizes withdrawals once consolidated liquidity is available.

Rebalancers

Independent actors who monitor pool status (activeLiquidity vs targetBalance) and quickly fill deficits (deposit) or remove surplus (withdraw) in exchange for IOU claims that can later be redeemed from surplus pools (with fee).

IOU redemption is permitted only from pools operating above their targetBalance — protecting operational liquidity. If a chosen pool is not in surplus, the Rebalancer must wait or select another pool for redemption.

Operational Flows in LBF

1. LP Liquidity Deposit → Parent Pool

An LP sends assets to the Parent Pool → LP share tokens are minted proportionally (see formulas below) → aggregate pool value is updated → targetBalance values for Child Pools may be adjusted.

2. User Cross-Chain Transfer

- User calls

bridge()on the source-chain LancaBridge. - ConceroRouter relays the message to the destination chain.

- Destination LancaBridge verifies the payload and executes payout (EOA or client contract).

3. Real-Time Rebalancer Role

A Rebalancer detects a Child pool deficit → deposits assets → receives IOU for the deposit amount → transfers IOU to a surplus chain (Concero V2 Messaging burn/mint) → redeems IOU for underlying assets + fee.

4. LP Withdrawal Logic

- LP burns LP tokens in the Parent Pool to request withdrawal.

- The Parent Pool temporarily raises its

targetBalanceby the withdrawal amount, intentionally moving itself into a deficit state — an economic signal to Rebalancers. - Rebalancers top up the Parent Pool toward the new target.

- Once actual balance meets target, LancaKeeper finalizes the withdrawal and transfers assets to the LP. Withdrawal time depends on system rebalancing speed, not a hard fixed delay.

Hybrid Liquidity Management

The LBF architecture blends centralized liquidity target planning (Parent Pool) with market-driven reactiveness (Rebalancers), minimizing idle capital while preserving fast local settlement.

Pool Status Variables

For each pool the following are tracked:

balancerebalancingFeesactiveLiquidity = balance - rebalancingFeestargetBalance(dynamic goal set by the Parent Pool)

Comparing activeLiquidity to targetBalance yields one of three states: Surplus, Balanced, Deficit. These states govern which Rebalancer actions are allowed.

Monitoring Cycle

The Parent Pool + LancaKeeper collect regular Child pool snapshots and adjust targetBalance in response to network activity. When a Child Pool drifts from its target, Rebalancers receive an economic signal to act.

Fast Rebalancer Adjustments

Rebalancers provide a “fast lane” between major Parent pool redistribution cycles: they deposit into deficit pools and withdraw from surplus pools using IOUs. This two-layer approach shortens system response time to load spikes.

IOU Redemption Constraint

IOU redemption is allowed only if the target pool’s balance exceeds its targetBalance, protecting operational liquidity and preventing depletion. Without surplus, the Rebalancer must wait or choose another pool.

Dynamic Liquidity Rebalancing Algorithm

To optimize capital allocation, the Parent Pool periodically recalculates each Child pool’s targetBalance using a Liquidity Health Score (LHS) that aggregates usage and stress metrics. The objective: move capital from “overfunded” pools to “high-demand” pools while keeping total system liquidity constant.

Metrics

Liquidity Utilisation Ratio (LUR)

Measures transaction intensity relative to the pool’s target. Higher volume vs target → higher utilization pressure.

Normalization:Sensitivity parameter (K) controls how quickly the score falls as activity rises.

Net Drain Rate (NDR)

Positive → net outflow (stress). Zero/negative → stable or net inflow.

Score:Liquidity Health Score (LHS)

Weighted aggregate of LUR and NDR:

Recomputing targetBalance

-

Weighting Function: Lower LHS → higher priority for capital allocation. Alpha is a sensitivity constant.

- Intermediate Pool Weight (W_i):

- Normalized Redistribution:

System-wide liquidity remains constant.

LBF Security

The Parent-Child Pool architecture introduces a critical liquidity concentration at the Parent Pool, compromise at this level could cascade across all Child pools, so strict privilege controls and validation are required.

Reliance on cross-chain communication (Concero V2 Messaging) means message integrity and authenticity are essential to settlement correctness and liquidity flows. Message validation failures could misdirect assets between chains.

The IOU burn/mint mechanism is vulnerable to replay attacks unless strict cross-chain message nonce handling is enforced; reprocessing a valid message could double-mint IOUs and enable economic exploitation.