What is Lanca Bridging Framework (LBF)?

The Problems that LBF Solves

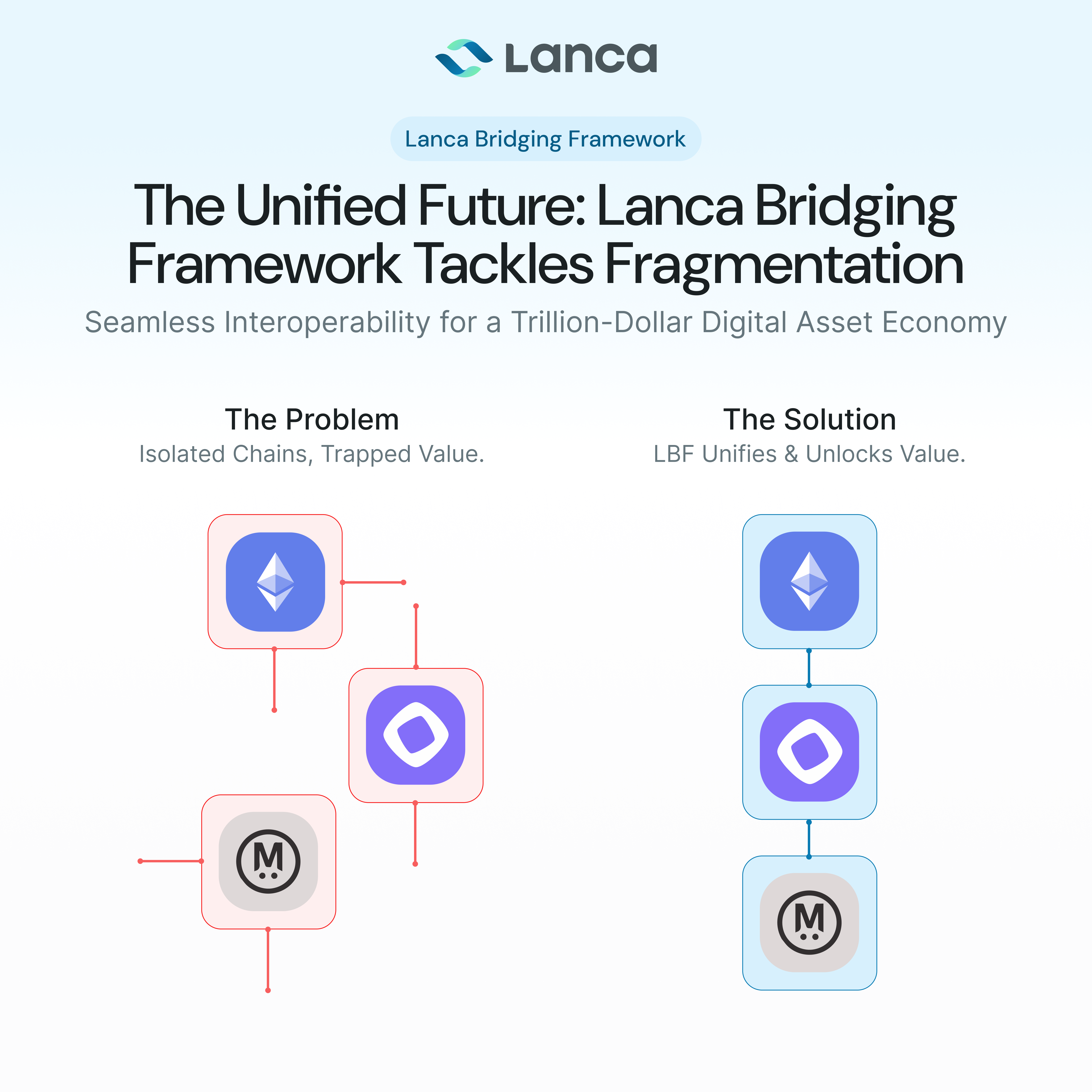

The digital asset world is highly fragmented, with hundreds of independent blockchain networks operating in isolation. This structure traps digital assets and liquidity within disconnected ecosystems, creating significant barriers to the seamless transfer of value across the industry.

As DeFi continues its explosive growth, with market projections exceeding $10 trillion by 2030, this fragmentation has become a critical roadblock. To sustain this momentum and unlock true innovation, users and developers urgently need the ability to move assets and interact across multiple chains without being confined to a single environment.

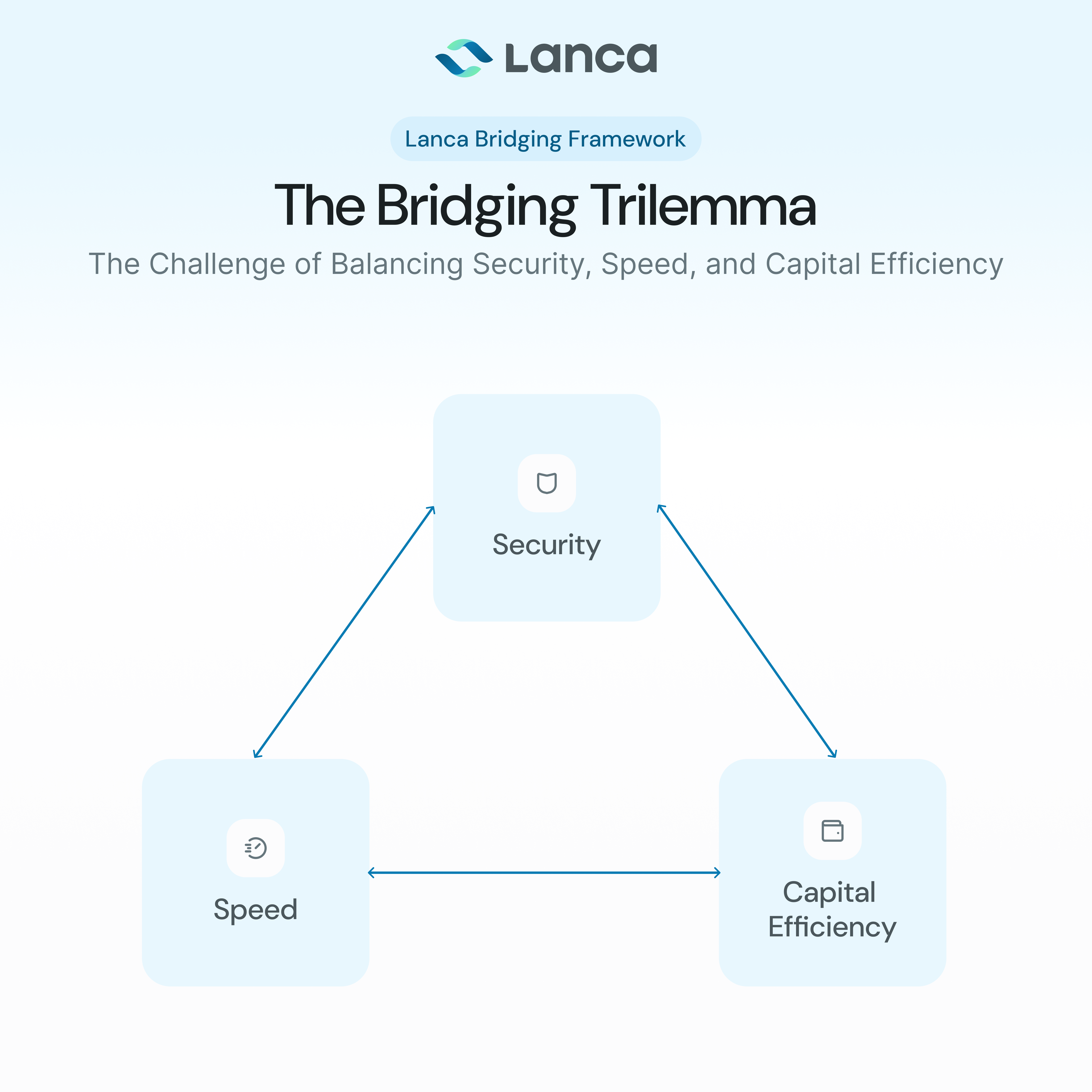

However, connecting these networks is a major technical challenge known as the "bridging trilemma," which highlights the difficulty of achieving security, speed, and capital efficiency all at once. Current cross-chain bridges often require vast amounts of locked-up capital, making them highly inefficient. Worse, they introduce severe security vulnerabilities, with over $2 billion lost to bridge exploits in recent years.

Existing solutions force users into difficult trade-offs between security, cost, and user experience. This failure of current infrastructure to provide a truly secure and efficient cross-chain solution underscores the critical need for a new approach.

How is LBF redefining the game?

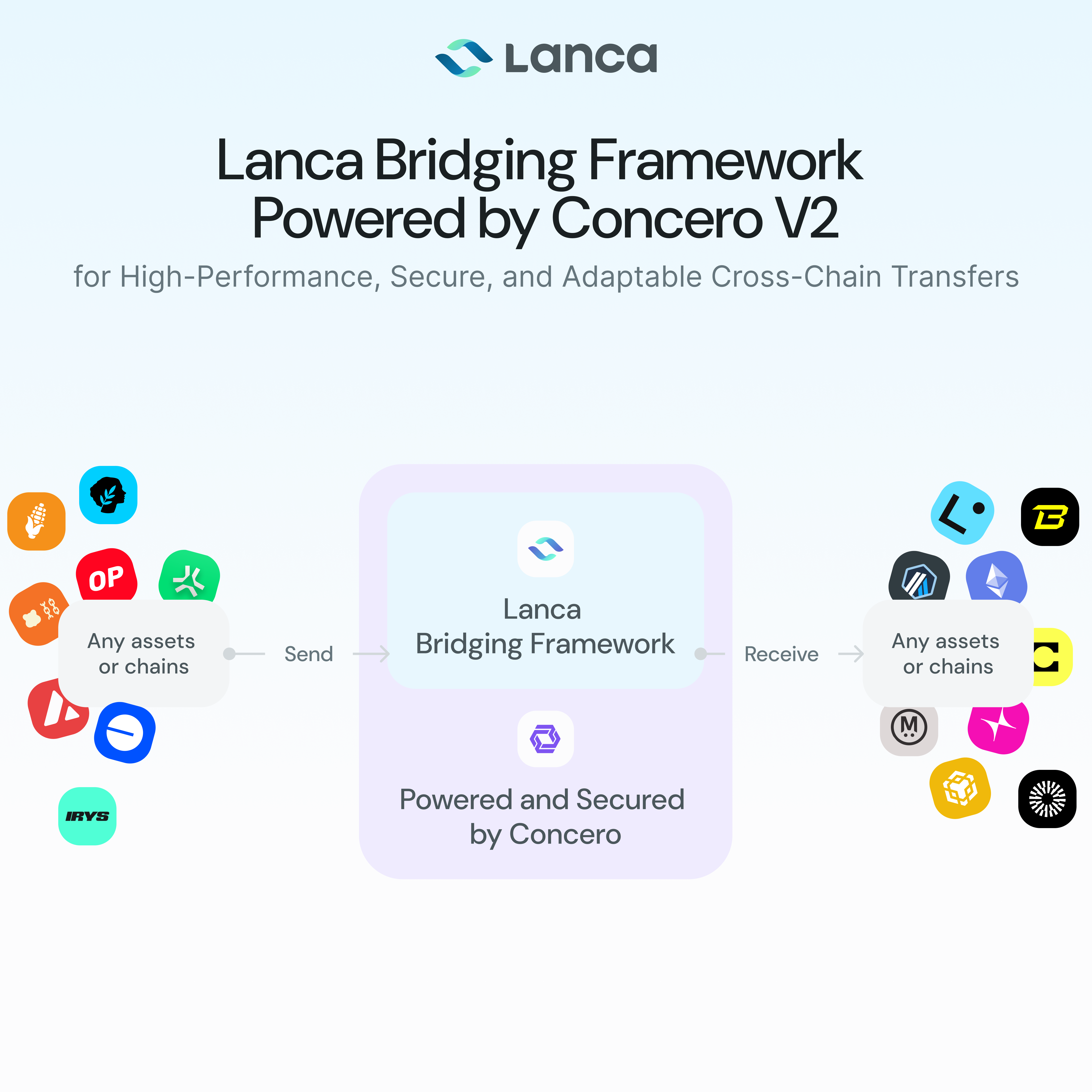

Developed by Concero Labs to address the challenges of a fragmented digital asset landscape, the Lanca Bridging Framework (LBF) is a fully decentralised cross-chain solution for seamless value transfer. It is specifically engineered to solve the "bridging trilemma" by delivering high speed, strong security, and excellent capital efficiency without compromise.

At its core is an innovative dual-layer, hybrid liquidity management system. This architecture combines a Parent-Child Pool model with a dynamic IOU (I-owe-you) mechanism to eliminate liquidity fragmentation and ensure capital is used efficiently across the network. The entire framework is powered by Concero V2 Messaging for secure communication and is maintained by automated operators (LancaKeepers) and independent participants (Rebalancers).

Key Advantages

- Unified Liquidity Layer: Liquidity providers can deposit into a single Parent Pool and gain fee exposure from all connected chains.

- Dynamic Allocation: Liquidity is dynamically allocated to each chain based on real-time network demand, minimising idle funds.

- Incentivised Rebalancing: The IOU mechanism incentivises Rebalancers to quickly cover liquidity deficits without requiring over-collateralisation.

- Flexible Rewards: Includes a configurable reward system to boost liquidity on underserved chains.

- Multi-Layer Security: The framework is protected by cryptographic, economic, and operational security models.